| Dear Retail Partners, At Glenyville, we are all about fostering strong relationships and continuously adding value to our esteemed retail partners. From curating exquisite, retail-ready Italian-made jewellery collections to crafting shared social media strategies, we are dedicated to enhancing your success. Today, we are thrilled to introduce a game-changing addition to our repertoire: the Procuret 4-month split payment option. Procuret is a cutting-edge business payment platform designed to empower our retailer partners by enabling them to spread invoice payments over a 4-month period, with four equal payments.Here’s why you should consider embracing the Procuret 4-month split payment option: Zero Finance Charges: We have worked with Procuret to provide eligible customers an instalment option where you pay no finance charges. As long as you pay your schedule of instalments on time, there are also no other fees or charges. This means you can maintain high stock levels of stunning Italian-made everyday jewellery essentials without any financial burden. Boost Cashflow: By splitting the invoice over 4 months, you significantly increase cashflow. Items are likely to be sold before the final payment, allowing you to earn a return on your investment before full payment is due. Budget with Confidence: The 4-month split ensures you can budget months in advance, preventing any major strain on your cashflow. Diverse Product Range: Enjoy all the benefits of stocking an extensive range of Italian-made jewellery, from everyday essentials to show-stopping pieces. This diversity allows your customers to choose from a wider selection, all while enjoying the convenience of a 4-month payment plan with no interest or ongoing fees, EVER. |

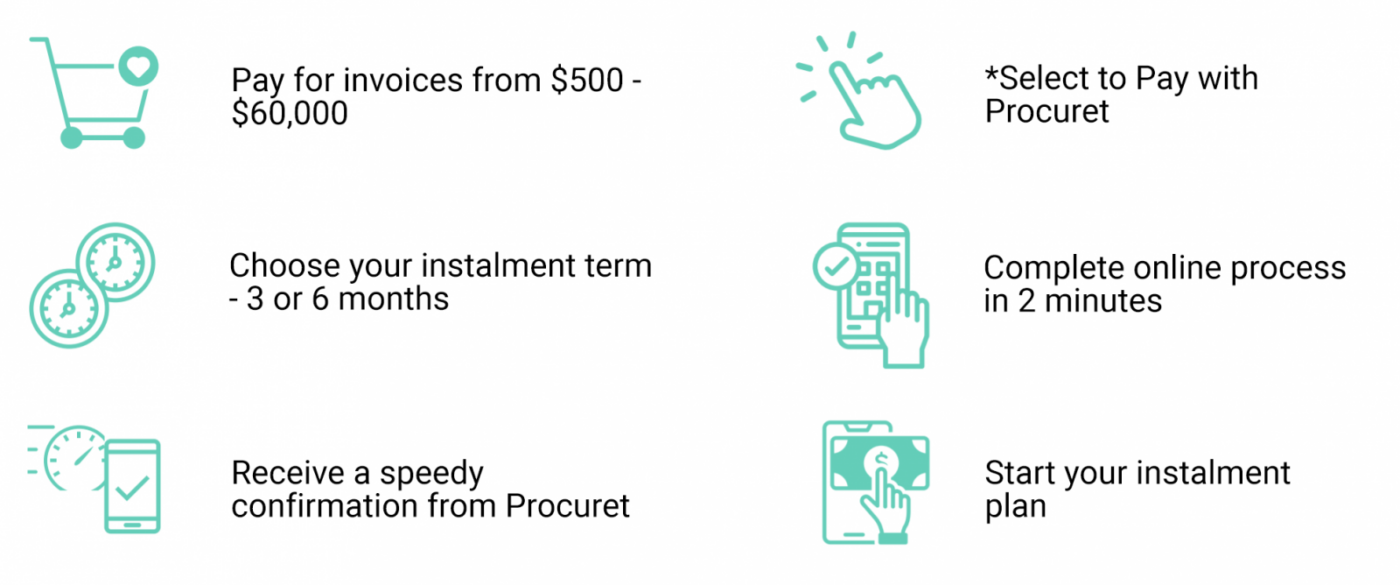

How Procuret Works for Business Clients

PROCURET FAQ

What is Procuret?

You now have the option to pay your invoice in smaller instalments over time though Procuret – it’s another way to add value to your business!

What do you Pay?

• The best way to think about Procuret is like choosing to pay your upfront insurance over 12 months rather than upfront

• So long as you pay your monthly instalments on time, there are no additional fees

Why Procuret?

• Cash management is an important consideration for any business

• Procuret is designed to smooth out larger invoices into small manageable payments

• Procuret’s payment option is fast, convenient, and simple and with no fuss or paperwork

How do you use Procuret?

• To pay in instalments, all you need to do is click the ‘Pay by Instalment’ option at the bottom of your Invoice or Proposal and follow the prompts

• Procuret uses a digital and data-based approach that relies on your ABN, bureau-based credit history and other parameters to assess qualification

• Qualification terms and eligibility criteria apply,

Does this impact any of the terms of engagement with the Supplier?

• No, Procuret is just another payment method. The obligations that you have under the terms of engagement with your supplier continue to apply. Warranties that you have with the supplier of your product, to apply directly with your Supplier.

Is there interest on the payment?

Your Supplier has negotiated with Procuret so that the monthly instalment is what you pay. The best way to think about it is like getting insurance paid monthly rather than upfront.

Are there any other fees?

So long as you pay your instalment on time, the monthly amount presented by Procuret is what you pay.

What if I pay late?

If there is a chance that you will miss a payment, please let Procuret know beforehand. If a payment dishonours once Procuret has attempted to direct debit your account, then a dishonour fee of $10 applies to cover the cost of re-running the payment and processing charges incurred. The payment will be attempted again the next day. If the payment continues to remain unpaid, further late charges may apply so it is always best if you can pay on time!+

It seems that it’s ‘Powered by Procuret’, what does that mean?

Procuret is an Australian based payment service focusing on business. Procuret can offer monthly instalments for invoices. Procuret does all the processing.

Am I able to prepay my instalment plan?

Yes, you can prepay at any time. There is a small prepayment charge depending on when in the contract term you request to prepay. Contact us on [email protected] if you wish to prepay.

Do I have to enter my credit card or bank details to pay monthly?

Yes. To make processing manageable for you and Procuret, instalment payments are made through authorised direct debit either via credit card or your business bank account.

Why is it asking me for my ABN details?

Procuret is a B2B payment platform. Requesting your ABN allows the instalments to be in the name of the business rather than you as an individual. Procuret runs data-based assessment criteria based on your ABN and other criteria.

Why is it asking me for my individual details?

This is to reduce the risk of fraud for all parties. It prevents scammers pretending to represent your business and as a payments company, Procuret also has a regulatory obligation to ensure it can identify the users of the service.

How do I contact Procuret customer support?

You can contact Procuret support via email [email protected] or via phone (02) 8866 5399